Ever paid $10 for your blood pressure med, then looked at your bill and thought, ‘Shouldn’t this be getting me closer to my deductible?’ You’re not alone. Thousands of people make this exact mistake every year-and it costs them money, time, and peace of mind.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay before your insurance starts sharing the cost of covered services. For example, if your deductible is $2,000, you pay the first $2,000 of medical or prescription costs yourself. After that, your plan kicks in with coinsurance.

Your out-of-pocket maximum is the most you’ll pay in a year for covered care. Once you hit that number-no matter how many doctor visits or prescriptions you’ve had-your insurance covers 100% of everything else for the rest of the year.

Here’s the key: generic copays count toward your out-of-pocket maximum, but they usually don’t count toward your deductible. That’s the twist most people miss.

Why do generic copays count toward the out-of-pocket maximum?

This wasn’t always the case. Before 2014, you could pay hundreds in prescription copays and still be nowhere near your deductible-or your out-of-pocket max. If you had diabetes, asthma, or high blood pressure, you were stuck paying the same copay every month with no progress toward relief.

The Affordable Care Act changed that. Starting in 2014, all new individual and employer plans had to include an out-of-pocket maximum, and all in-network cost-sharing-deductibles, coinsurance, and copays-had to count toward it. That means every $10 you pay for a generic drug adds to your total out-of-pocket spending. If your out-of-pocket max is $8,500, and you’ve paid $8,490 in copays, your next prescription is free.

That’s a huge win for people who need regular meds. One user on PatientsLikeMe said they hit their $8,500 cap last year after paying $15 copays for insulin every month. After that, their insulin was free for the rest of the year. Without the ACA rule, they’d still be paying $15 a month, no matter how much they’d spent.

But why don’t generic copays count toward the deductible?

This is where the confusion kicks in. Insurance companies keep deductibles and copays separate for financial reasons. Deductibles are designed to make you think twice before using care. Copays are meant to be a flat fee that’s easy to budget.

If copays counted toward your deductible, you’d hit your deductible faster-maybe after just a few prescriptions. That means your insurance starts paying more sooner, which costs the insurer more money. So they design plans where:

- You pay the full cost of prescriptions until you meet your prescription deductible (if there is one).

- After that, you pay a copay-say $10 for generics-but those $10 payments only count toward your out-of-pocket max, not your medical deductible.

So you could pay $3,000 in generic copays over the year, think you’ve met your $3,000 deductible, and then get hit with a $5,000 bill for an MRI because your deductible hasn’t moved. That’s not a mistake-it’s how the plan is built.

How your plan type changes everything

Not all plans work the same. There are three main types:

- Single deductible (27% of plans): One deductible covers both medical and prescriptions. If you pay $50 for a prescription, it counts toward your $2,000 deductible. No separate copays. Once you hit the deductible, coinsurance applies.

- Separate medical and prescription deductibles (37% of plans): You have two deductibles. Say $1,500 for doctor visits and $1,000 for prescriptions. You pay full price for meds until you hit the $1,000 prescription deductible. Then you pay $10 copays-but those copays still don’t count toward your $1,500 medical deductible.

- Copay-only with no prescription deductible (36% of plans): No prescription deductible. You pay $10 for every generic right away. Those $10 payments count toward your out-of-pocket max, but not your medical deductible.

Most people assume their plan is type 1. But if you’re paying copays for meds and still owe thousands for a hospital visit, you’re probably in type 2 or 3.

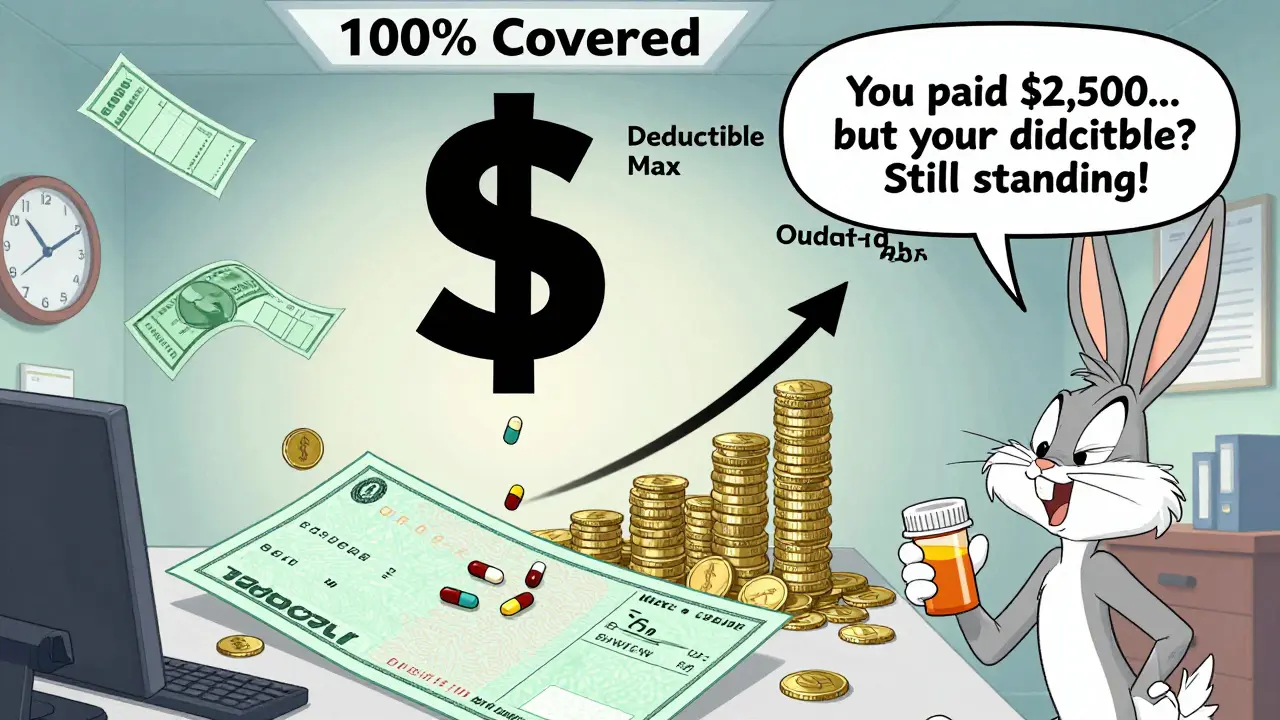

Real-world confusion: The ,500 copay myth

A user on HealthCare.gov wrote: “I paid $10 copays for my meds all year. That’s over $2,500. I thought I’d met my $2,000 deductible. But when I went for a knee MRI, I got hit with a $1,200 bill. Why?”

Because copays don’t move your deductible. That $2,500 went toward your out-of-pocket max, not your deductible. So your deductible was still at $2,000. You had to pay it all over again.

A 2023 survey by America’s Health Insurance Plans found that 68% of people think copays count toward their deductible. Only 22% got it right. That’s a massive gap between what people believe and how their plan actually works.

How to find out how your plan works

You don’t have to guess. Your plan gives you two documents:

- Summary of Benefits and Coverage (SBC): This is a 2-4 page form every insurer must give you before you enroll. Look for the section titled “Cost-Sharing” or “How much will you pay?” It will show exactly what counts toward your deductible and what counts toward your out-of-pocket max.

- Explanation of Coverage (EOC): This is the full plan document. Search for “deductible,” “copayment,” and “out-of-pocket maximum.” If it says “copays do not count toward the deductible,” that’s your answer.

Pro tip: Don’t wait until you’re sick to read this. Open enrollment is the best time. Spend 45 minutes on it. It’s the most important health decision you’ll make all year.

What’s changing in 2025 and beyond

The government is trying to fix the confusion. In April 2024, the Department of Health and Human Services required insurers to make cost-sharing rules clearer on all documents and apps. Starting in 2025, your plan must clearly say:

- Which payments count toward your deductible

- Which ones count toward your out-of-pocket max

- Whether prescriptions have a separate deductible

Some insurers are testing new models. In five states, pilot programs are letting prescription copays count toward a single, combined deductible. Early results show patients take their meds more often because they understand how their money is being spent.

McKinsey & Company predicts that by 2027, 60% of major insurers will offer at least one plan where generic copays count toward the deductible. Why? Because consumers are fed up. They want simplicity.

But there’s a trade-off. If copays count toward deductibles, premiums could go up 3-5% per year. Insurers say that’s the cost of clarity.

What you should do now

Here’s your action plan:

- Find your SBC document. If you can’t find it, call your insurer or log into your member portal.

- Look for the words “deductible” and “copay.” Check the column that says “Does this count toward your deductible?”

- If you pay copays for prescriptions, write down how much you’ve paid this year. Then check your out-of-pocket max. If you’re close, your next prescriptions might be free.

- If you’re on a plan with separate deductibles, track your prescription spending separately from your doctor visits.

- Ask your pharmacist: “Do these copays count toward my deductible or just my out-of-pocket max?” They often know the plan better than you do.

Understanding this isn’t about being a financial expert. It’s about making sure you’re not paying more than you have to. Millions of people pay thousands in out-of-pocket costs every year because they don’t know how their plan works. You don’t have to be one of them.

What happens when you hit your out-of-pocket maximum?

Once you hit your out-of-pocket max for the year, your insurance pays 100% of all covered services for the rest of the year. That includes:

- Doctor visits

- Lab tests

- Hospital stays

- Prescriptions

It doesn’t matter if you’ve met your deductible or not. Once you hit the cap, you’re done paying. No coinsurance. No copays. Nothing.

That’s the whole point of the out-of-pocket maximum: to protect you from financial ruin. If you’re on chronic meds, that cap is your safety net.

And here’s the quiet truth: generic copays are your quiet ally. They’re small, but they add up. Every $10 you pay for a pill is one step closer to that safety net. You just have to know where you’re standing.

Do generic prescription copays count toward my deductible?

In most cases, no. Generic copays typically do not count toward your medical deductible. They count toward your out-of-pocket maximum, but your deductible remains unchanged unless you pay full price for prescriptions before meeting a separate prescription deductible.

Do copays count toward my out-of-pocket maximum?

Yes. Under the Affordable Care Act, all in-network cost-sharing-including generic prescription copays-counts toward your out-of-pocket maximum. This means every copay you pay adds to your total, bringing you closer to the point where your insurance pays 100% of covered services.

What’s the difference between a prescription deductible and a medical deductible?

A medical deductible applies to doctor visits, hospital stays, and other medical services. A prescription deductible applies only to medications. Some plans have both. You must meet each one separately. Copays for prescriptions usually only count toward the out-of-pocket maximum, not either deductible.

How do I know if my plan has a separate prescription deductible?

Check your Summary of Benefits and Coverage (SBC). Look for a section labeled “Prescription Drugs” or “Cost-Sharing.” It will show whether there’s a separate deductible for medications. If it says “You pay full price until you meet your prescription deductible,” then yes, it’s separate.

What happens if I pay $10 copays for 200 prescriptions in a year?

That’s $2,000 toward your out-of-pocket maximum. If your max is $9,200 (2025 limit), you’re still $7,200 away. But if you have a $3,000 deductible and haven’t met it yet, you’ll still owe that $3,000 for other services like hospital visits. The copays don’t help you meet the deductible-they only help you reach your out-of-pocket cap.

Can I switch plans to make copays count toward my deductible?

Not right now. Most plans still keep deductibles and copays separate. But starting in 2027, more insurers may offer plans where generic copays count toward a single combined deductible. For now, your best move is to choose a plan with a single deductible or no prescription deductible at all. Review your SBC carefully during open enrollment.

Next steps: What to do before open enrollment

If you’re on a plan with separate deductibles and you take regular meds, consider switching during open enrollment. Look for:

- A plan with a single deductible (covers both medical and prescriptions)

- A plan with no prescription deductible (you pay copays right away, and they count toward your out-of-pocket max)

- A plan with a lower out-of-pocket maximum

Don’t just pick the cheapest premium. Pick the plan that fits your actual use. If you spend $1,200 a year on meds, a $500/month premium with a $1,500 deductible might cost you more than a $700/month plan with a $1,000 deductible and no prescription deductible.

Use the SBC to compare plans side by side. The government made them standardized for a reason: so you can actually compare them.

And remember: your out-of-pocket maximum isn’t a target. It’s a shield. Every copay you pay is a brick in that shield. You just need to know where you’re building it.

Raushan Richardson

December 27, 2025 AT 21:44So I paid $120 in copays this year for my asthma inhalers and thought I was halfway to my deductible... turns out I was just building my out-of-pocket shield. Thanks for the clarity. I’m not dumb, I just got lied to by my insurance portal.

Andrew Gurung

December 29, 2025 AT 07:07Oh wow, you mean insurance companies don’t want you to get free stuff? Shocking. 🤡 Next you’ll tell me water is wet and the sun rises in the east. I’m so mad I cried into my $15 generic pill bottle.

Paula Alencar

December 30, 2025 AT 10:25Let me just say, as someone who manages chronic illness while working full-time and raising two kids, this distinction between deductible and out-of-pocket maximum isn’t just a technicality-it’s a lifeline. The fact that every $10 copay now moves us closer to relief? That’s not policy. That’s dignity. And it’s about time we stopped treating healthcare like a puzzle designed to confuse the sick.

Nikki Thames

December 31, 2025 AT 23:50It’s not that people don’t understand the system-it’s that the system was intentionally designed to be incomprehensible. Capitalism doesn’t want you to be healthy. It wants you to be indebted, compliant, and quietly suffering while you pay for the privilege. The ACA didn’t fix healthcare. It just gave us a slightly less cruel version of the same nightmare.

Chris Garcia

January 1, 2026 AT 17:13In Nigeria, we don’t have insurance like this-we have family, neighbors, and prayer. But I see your struggle. You pay $10 for a pill, and the system says, ‘This doesn’t count.’ That’s not finance. That’s betrayal. When your body is your only currency, and even that is taxed by bureaucracy… what are we really paying for? Not medicine. Not care. Just permission to survive.

James Bowers

January 2, 2026 AT 15:4368% of people think copays count toward deductibles? That’s not ignorance. That’s negligence. If your insurer can’t communicate basic terms, they should be fined. This isn’t rocket science-it’s a two-sentence disclosure. Fix it.

Will Neitzer

January 3, 2026 AT 11:45Thank you for this meticulously researched breakdown. The SBC document is the single most underutilized tool in American healthcare. I’ve had clients pay $20,000 in out-of-pocket costs because they assumed their copays were ‘progress.’ They weren’t. They were just fuel for the insurance machine. Please, everyone-print your SBC. Highlight it. Tape it to your fridge.

Janice Holmes

January 4, 2026 AT 06:08MY INSURANCE IS A LIE. I PAID $1800 IN COPAYS AND STILL GOT BILLED $6000 FOR AN MRI. I’M NOT JUST BROKE-I’M BETRAYED. THIS IS PSYCHOLOGICAL TERROR WITH A COBRA FORM.

Gerald Tardif

January 5, 2026 AT 21:52You’re not alone. I used to think I was bad at budgeting. Turns out, I was just playing a rigged game. Now I track every copay like a spreadsheet warrior. I’ve got a little tab labeled ‘Shield Builder.’ Every $10 is a brick. I’m 70% there this year. One more month of insulin, and I’m free. That’s my victory lap.

Satyakki Bhattacharjee

January 7, 2026 AT 18:20People are too lazy to read the fine print. If you don’t know your plan, you deserve to pay more. This isn’t hard. It’s just inconvenient for you.

Kishor Raibole

January 7, 2026 AT 21:27Actually, the real problem is that the ACA didn’t go far enough. Why should copays count toward the out-of-pocket maximum at all? Why not eliminate deductibles entirely? The system is still built on punishment. We need single-payer, not tweaks to the prison.

John Barron

January 8, 2026 AT 00:27Okay, but have you considered that if your meds cost $10, maybe you shouldn’t be on them? 🤔 Maybe you need to meditate more? Or try turmeric? I’ve been off all prescriptions for 3 years and I’m 100% healed. Your body is a temple. Stop feeding it corporate chemicals. 💆♂️💊✨

Alex Lopez

January 8, 2026 AT 05:14As a former insurance underwriter, I can confirm: the separation of deductible and out-of-pocket maximum is not an accident-it’s a feature. It’s designed to maximize revenue while minimizing perceived cruelty. The fact that you’re surprised means the marketing worked. We didn’t lie. We just omitted. And in healthcare, omission is the most profitable form of deception.

Liz MENDOZA

January 9, 2026 AT 14:32I just shared this with my mom. She’s 72, on Medicare Advantage, and thought her $5 copays were reducing her deductible. She cried. I cried. We’re going to the pharmacy tomorrow with the SBC in hand. Thank you for turning confusion into power. This is the kind of information that saves lives-not just money.